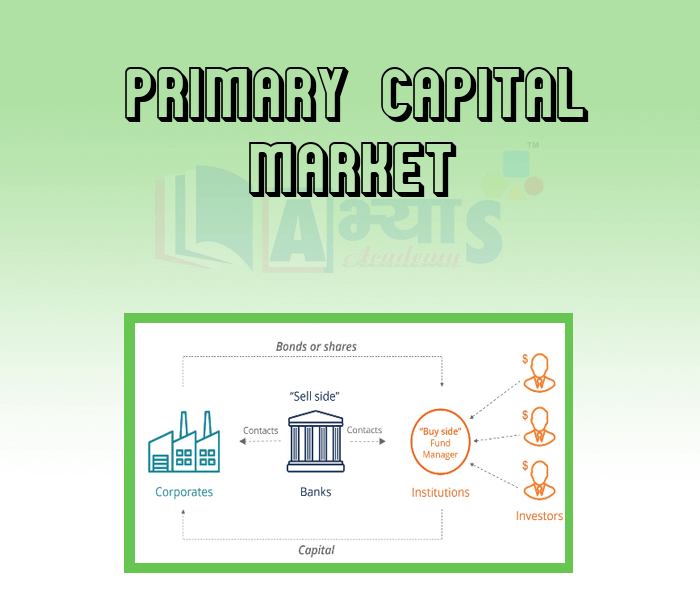

Primary Capital Market

Primary Capital Market

Types Of Public Issues:

Initial Public Offering - IPO

When an unlisted company in order to raise the capital, invites the purchase applications from the public for its new equity shares through an offer, the offer is known as Initial Public Offering. Any company can bring IPO only once.

Follow On Public Offering - FPO

When a listed company in order to raise the capital, invites the purchase applications from the public for its new equity shares through an offer, the offer is known as Follow - on Public Offer. In other word any company issuing its new shares to the public other than the first time.

Rights Issue

Here, a listed organization proposes to issue fresh securities to its existing shareholders as on a record date. The rights are offered in a particular ratio to the number of securities held prior to the issue. This route is best suited for organizations who would like to raise capital without diluting the stake of its existing shareholders. In other word the existing shareholders are offered right of first denial. These shares can be sold to others only when existing shareholders don't purchase these shares.

Students / Parents Reviews [10]

My experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thMy experience with Abhyas is very good. I have learnt many things here like vedic maths and reasoning also. Teachers here first take our doubts and then there are assignments to verify our weak points.

Shivam Rana

7thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.

Om Umang

10thMy experience with Abhyas academy is very good. I did not think that my every subject coming here will be so strong. The main thing is that the online tests had made me learn here more things.

Hiya Gupta

8thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thOne of the best institutes to develope a child interest in studies.Provides SST and English knowledge also unlike other institutes. Teachers are co operative and friendly online tests andPPT develope practical knowledge also.

Aman Kumar Shrivastava

10thIt has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thA marvelous experience with Abhyas. I am glad to share that my ward has achieved more than enough at the Ambala ABHYAS centre. Years have passed on and more and more he has gained. May the centre flourish and develop day by day by the grace of God.